The Stewart ELFund

The Stewart Emergency Loan Fund was established in 2008 to honor the work and vision of Caryl Stewart, President Emeritus and Founder of Opportunities Credit Union. The ELF is used to provide emergency loans at very low rates to individuals in our community who need small loans but who otherwise do not qualify for traditional loan programs. Often these loans prevent increased financial instability, help keep a vehicle running, prevent homelessness, address medical or dental needs, for burial expense, fuel purchases and other family needs.

ELF Fund Target Market:

- Individuals with emergencies needing small loans

- Individual whose only source of funding may be predatory loan products or pay day lenders

- Individuals with challenging credit histories

- Situations where a small loan amount may avoid a loss of job, homelessness or other negative results.

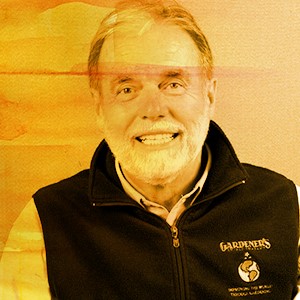

The Gardner Fund

This fund was established to honor the dedication and entrepreneurial spirit of our former Board Chair Oliver Gardner. It provides affordable micro business loans to entrepreneurs in our community who like Oliver aspire to start a business, build assets, create jobs for themselves and others in the community. It targets individuals who demonstrate the motivation and skills to turn their vision into a viable business. The fund was established with an initial $50,000 contribution in June 2011. The Gardner Fund serves as a loan loss reserve to mitigate risk for micro business loans that due to the nature of the target market and the variables in a start-up- carry a greater risk. This fund addresses the regulatory requirements for safety and soundness.

Gardner Fund’s Target Market:

- Start-ups and existing businesses who cannot qualify for conventional financing through traditional lenders

- Borrowers who may have any of the following:

- Limited or no credit

- Non-traditional credit

- Lack of down payment/equity in collateral

- Language barriers

- The need for additional support in order to successfully start or build their business

- Borrowers actively working with either the SBA (Small Business Administration), SCORE (Service Core of Retired Engineers) or MBDP Micro Business Development Program/CVOEO) on their business, marketing and financial plans.

- Businesses where this may be an additional source of income (income patching) to the borrower

- Borrowers from areas with high levels of poverty and unemployment.

Gilligan Kids “Adventures in Savings” Fund

The Gilligan Kids “Adventures in Savings” Fund was established in 2014 to honor John Gilligan who was a longtime volunteer member at Opportunities. It was John’s wish to make it possible for more children to learn to save and towards this goal John’s family started this fund in his honor. John recognized that not all children come from families with savings and John wanted to make this possible for every child. Data from the Federal Reserve shows a direct correlation between a child having a savings account and the increased likelihood that they will go to college. The Opportunities Board recognized John’s many contributions with an additional donation bringing the initial fund to $10,000. Money from the fund may be used for opening deposits to start a “Super Duper KIDS Savers” account, provides rewards for regular savings and funds scholarships for kids along with other activities that encourage building strong financial skills from an early age. Opportunities will continue to grow the fund to ensure that all children can become regular, active savers.